Hydrogen-Powered Mining: Science Fiction or the Next Reality for Crypto?

Introduction

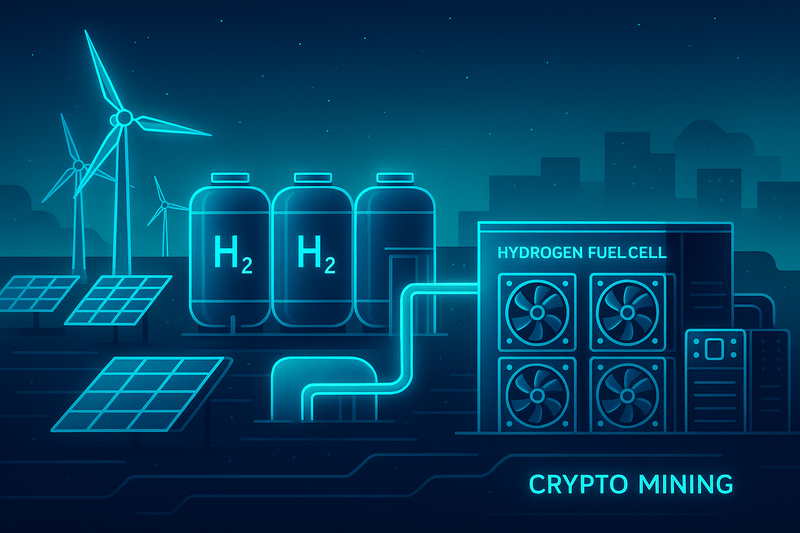

Crypto mining consumes vast amounts of electricity, drawing criticism for its environmental impact. Renewable energy sources like solar and wind are already reshaping the industry — but what about hydrogen? Could hydrogen become the clean energy source that powers the next generation of mining operations, or is it just science fiction?

What Is Hydrogen Power?

Hydrogen can be used as a clean energy source when produced via electrolysis (splitting water using renewable electricity). The result is “green hydrogen,” which can power engines, turbines, or fuel cells without direct carbon emissions.

Types of hydrogen:

-

Grey Hydrogen – Made from fossil fuels, high emissions.

-

Blue Hydrogen – Fossil-based, but paired with carbon capture.

-

Green Hydrogen – Produced with renewable electricity, zero emissions.

For crypto mining to claim sustainability, green hydrogen is the only viable option.

How Hydrogen Could Power Mining

-

Fuel Cells for On-Site Generation

-

Mining farms could deploy hydrogen fuel cells as localized, zero-emission generators.

-

This avoids grid bottlenecks and provides independent power supply.

-

-

Hybrid Models

-

Hydrogen plants could store excess renewable energy and release it as power when miners need stable, 24/7 electricity.

-

-

Stranded Energy Use

-

Remote hydrogen projects (e.g., in Australia’s outback or the Middle East) could colocate with mining farms, monetizing surplus energy.

-

Benefits of Hydrogen-Powered Mining

-

Zero Direct Emissions: Green hydrogen provides carbon-free electricity.

-

Energy Storage: Acts as a long-term storage medium for variable renewables.

-

Off-Grid Flexibility: Miners could operate in remote locations without grid dependence.

Challenges and Limitations

-

Cost

-

Green hydrogen remains expensive: typically $4–6/kg, equivalent to $0.20–0.30/kWh — often higher than grid power.

-

-

Efficiency Losses

-

Electrolysis, storage, and conversion back to electricity all introduce losses, making hydrogen less efficient than direct use of renewables.

-

-

Infrastructure

-

Hydrogen pipelines, storage, and distribution are still limited. Scaling for large mining operations would require major investment.

-

-

Competition for Use

-

Hydrogen is also sought for transport, steelmaking, and aviation. Mining may not be a priority sector.

-

Real-World Signals

-

Australia: Pilbara hydrogen hubs are planned, with potential co-location of data centers or mining farms.

-

Europe & Japan: Heavy investment in hydrogen fuel cells may trickle down to industrial energy users.

-

Crypto Industry: So far, no major hydrogen-powered mining farms exist — but pilot projects may emerge within the decade.

Science Fiction or Next Reality?

Right now, hydrogen-powered mining leans closer to science fiction due to cost and infrastructure barriers. But within 10–15 years, as hydrogen prices fall and renewable expansion accelerates, it could become a reality for miners seeking:

-

Off-grid independence.

-

Zero-carbon operations.

-

A hedge against grid volatility.

Hydrogen won’t replace renewables or batteries soon, but it could become part of a multi-energy mining future.

Conclusion

Hydrogen-powered mining isn’t here yet — but it’s on the horizon. With global investment in hydrogen infrastructure growing, miners may one day fuel their rigs with the most abundant element in the universe. The big question isn’t “if,” but “when.”